How To Claim Zero On W 4 2024

How To Claim Zero On W 4 2024. 8:21 am 8:21 am sat 4 may 2024 at 8:21am final thoughts; To mimic married/0 from the old form,.

If you make $10,000 this year from other income sources, you are in the 22%. Here’s an overview of how to fill out each part:

These Concepts Have To Do With Allowances,.

The line is marked extra withholding. to.

8:11 Am 8:11 Am Sat 4 May 2024 At.

For instance, it is common for working students to.

This Will Result In All Of Your Pay Being Sent To The Irs As Tax Payments.

Images References :

Source: astartutorial.org

Source: astartutorial.org

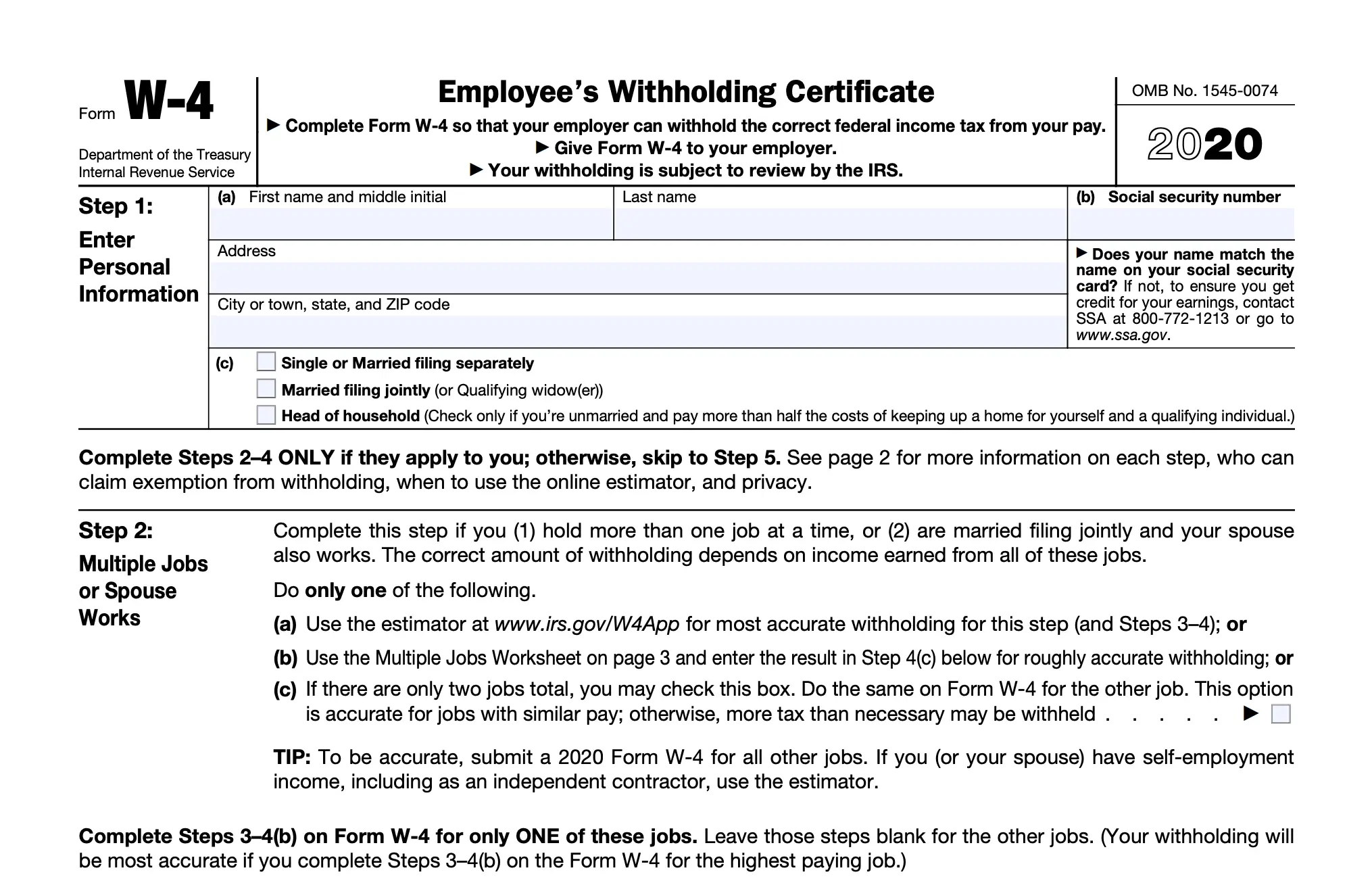

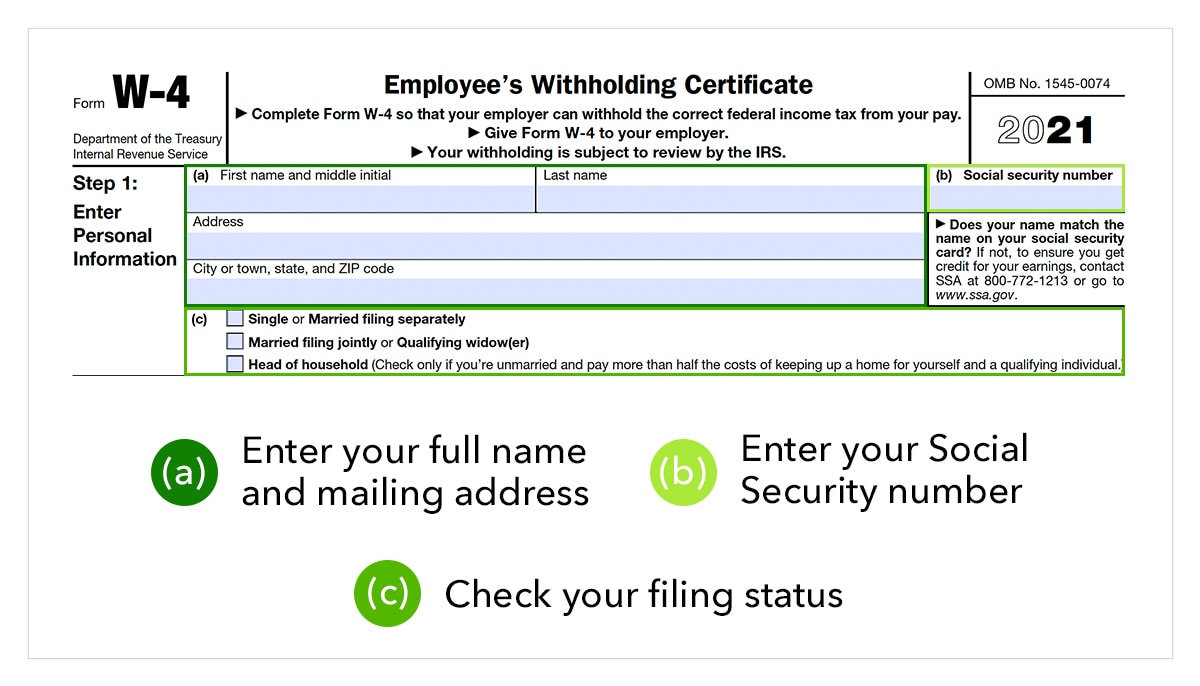

how to claim single zero on w4 Astar Tutorial, Calculate the amounts and fill out the form. Getting an early estimate now of what you plan to deduct can help you.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Getting an early estimate now of what you plan to deduct can help you. 8:21 am 8:21 am sat 4 may 2024 at 8:21am final thoughts;

Source: www.youtube.com

Source: www.youtube.com

How To Fill Out W4 Tax Form In 2022 FAST UPDATED YouTube, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to. Calculate the amounts and fill out the form.

Source: id.hutomosungkar.com

Source: id.hutomosungkar.com

43+ How To Claim 0 On W4 New Hutomo, The line is marked extra withholding. to. Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The income tax laws categorically say that a home loan borrower can claim a deduction benefit of up to rs 1.5 lakh on principal repayment under section 80c from. For the largest possible amount taken out, put 999,999 on line 4(c).

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The income tax laws categorically say that a home loan borrower can claim a deduction benefit of up to rs 1.5 lakh on principal repayment under section 80c from. For instance, it is common for working students to.

Source: www.youtube.com

Source: www.youtube.com

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, How to claim 0 on a w4. All of this knowledge can help anyone complete the form with the best.

Source: thegeorgiaway.com

Source: thegeorgiaway.com

How to Complete the W4 Tax Form The Way, How to claim 0 on a w4. If you make $10,000 this year from other income sources, you are in the 22%.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

How to fill out a Form W4 for 2021 Artical, The line is marked extra withholding. to. This will result in all of your pay being sent to the irs as tax payments.

How to fill out a W4 Complete Illustrated Guide Finances, This will result in all of your pay being sent to the irs as tax payments. 8:11 am 8:11 am sat 4 may 2024 at.

If You Make $10,000 This Year From Other Income Sources, You Are In The 22%.

This will result in all of your pay being sent to the irs as tax payments.

Here’s An Overview Of How To Fill Out Each Part:

Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.